As part of the Mid-value analysis conducted by the Fundraising Insights program, we observed that about half of mid-value donors were sourced as brand-new recruits. Not upgrades from standard-value, but rather, never seen before brand new donors to our members. It prompted us to think about what triggers them to give and how we can identify more donors like them. We recommended including a high-value ask along with your regular asks in acquisition.

The Alfred Foundation was the first of many organisations to use this suggestion, and their October acquisition included an ask amount of $1,000.

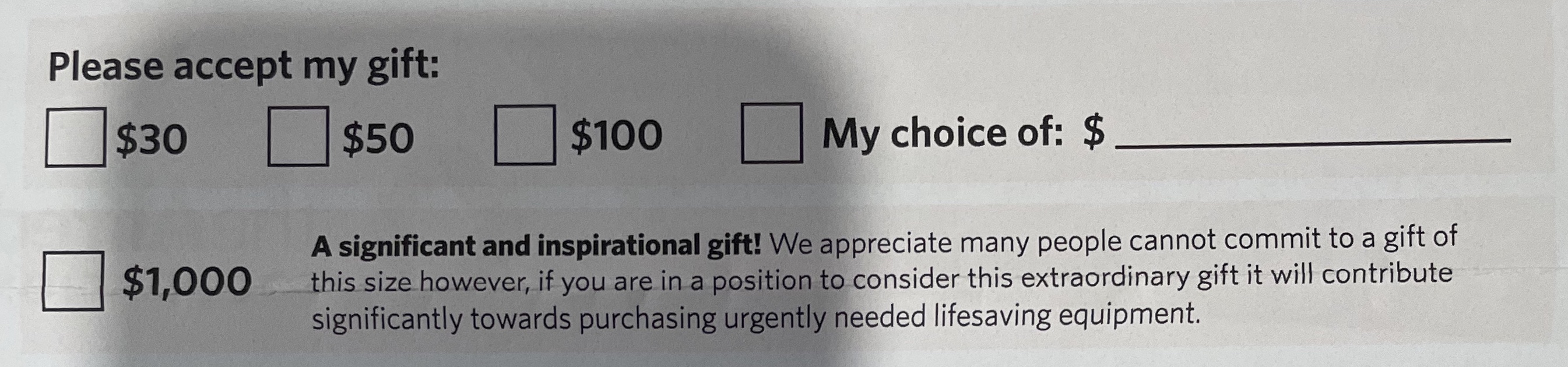

We’ve had the opportunity to run the results for this campaign and compare them to their other recent acquisitions, and the results are very compelling. First, let’s look at how the ask was delivered. [image of response mechanism].

The results

There are a few important factors to note with the acquisitions so far. September 2021 was The Alfred’s first acquisition, so it was always likely to have a strong response rate with a good pack. The December 2021 mailing was a roll-out of the same pack with slightly different targeting (including a younger audience) and a small volume of repeat recipients. The October 2022 mailing was a more focused audience, with a quarter of supporters receiving a premium. It was also the first pack that included the $1,000 stretch ask in acquisition.

| Acquisition Results | ||||||||

| Acquisition | Mailed | Cost | Responded | Response Rate | Income | Net Income | Average Gift | ROI |

|---|---|---|---|---|---|---|---|---|

| September 2021 | 19,889 | $58,873 | 690 | 3.47% | $43,339 | ($15,534) | $62.81 | 0.74 |

| December 2021 | 55,907 | $91,711 | 703 | 1.26% | $48,928 | ($42,782) | $69.60 | 0.53 |

| October 2022** | 19,650 | $49,292 | 436 | 2.22% | $40,243 | ($9,049) | $92.30 | 0.82 |

We observe some key differences when we look at the results from the October 2022 mailing. The response rate is not as high as the first acquisition, but the average gift and ROI clearly outperform the previous two campaigns.

| High-Value Acquisition Results | ||||||

| Performance of gifts at $1,000+ | ||||||

| Acquisition | High Value Gifts | High Value Gift Prop | High Value Gift Mean | High Value Gift Min | High Value Gift Max | Non High Value Gift Mean |

|---|---|---|---|---|---|---|

| September 2021 | 1 | 0.14% | $1,000 | $1,000 | $1,000 | $61.45 |

| December 2021 | 1 | 0.14% | $3,000 | $3,000 | $3,000 | $65.43 |

| October 2022** | 8 | 1.83% | $1,250 | $3,000 | $3,000 | $70.66 |

This acquisition had the most gifts at $1,000 compared to the other recent acquisitions. The table above shows the rate of donors making $1,000+ gifts. The results are small but statistically significant (based on a Fisher Exact Test, a statistical significance test valid for all sample sizes). The impact of these gifts to help provide a healthy ROI is also evident.

| High-Value Acquisition Results | |||

| Income mix from gifts of $1,000+ | |||

| Acquisition | High Value Gift Income | Non High Value Gift Income | High Value Gift Proportion |

|---|---|---|---|

| September 2021 | $1,000 | $42,339 | 2.31% |

| December 2021 | $3,000 | $45,928 | 6.13% |

| October 2022** | $10,000 | $30,243 | 24.85% |

Finally, the contribution to the income from gifts of $1,000+ has shifted from 2.31% to almost 25% of the total income raised. While the volume of gifts at $1,000 may not be large, it helps to offset the investment in acquisition by improving ROI, and it helps to grow the scale of our high-value giving programs.

Last words

Fundraising Insights helped to uncover this strategy that has helped identify new mid-value donors, working to help improve the outcomes from investment in acquisition at a time when achieving acceptable ROI is getting harder and harder. If you’re planning an investment in cash donor acquisition, make sure to build this into your plans.

If you’re not getting strategic recommendations like this from your benchmarking provider, it’s not too late to register for the FY24 round of Fundraising Insights.