It’s often been said by consultants and those selling cash acquisition products that you must do Cash acquisition as it’s where you find your Mid Value and Major Donors. We’ve recently presented our first Fundraising Insights report, and the findings challenge traditional consultant thinking.

In looking at where our Mid Value and Major Donors are sourced from, our analysis shows that 50% or more first-time high-value givers (donors at the $1,000+ value) are new to our member organisations.

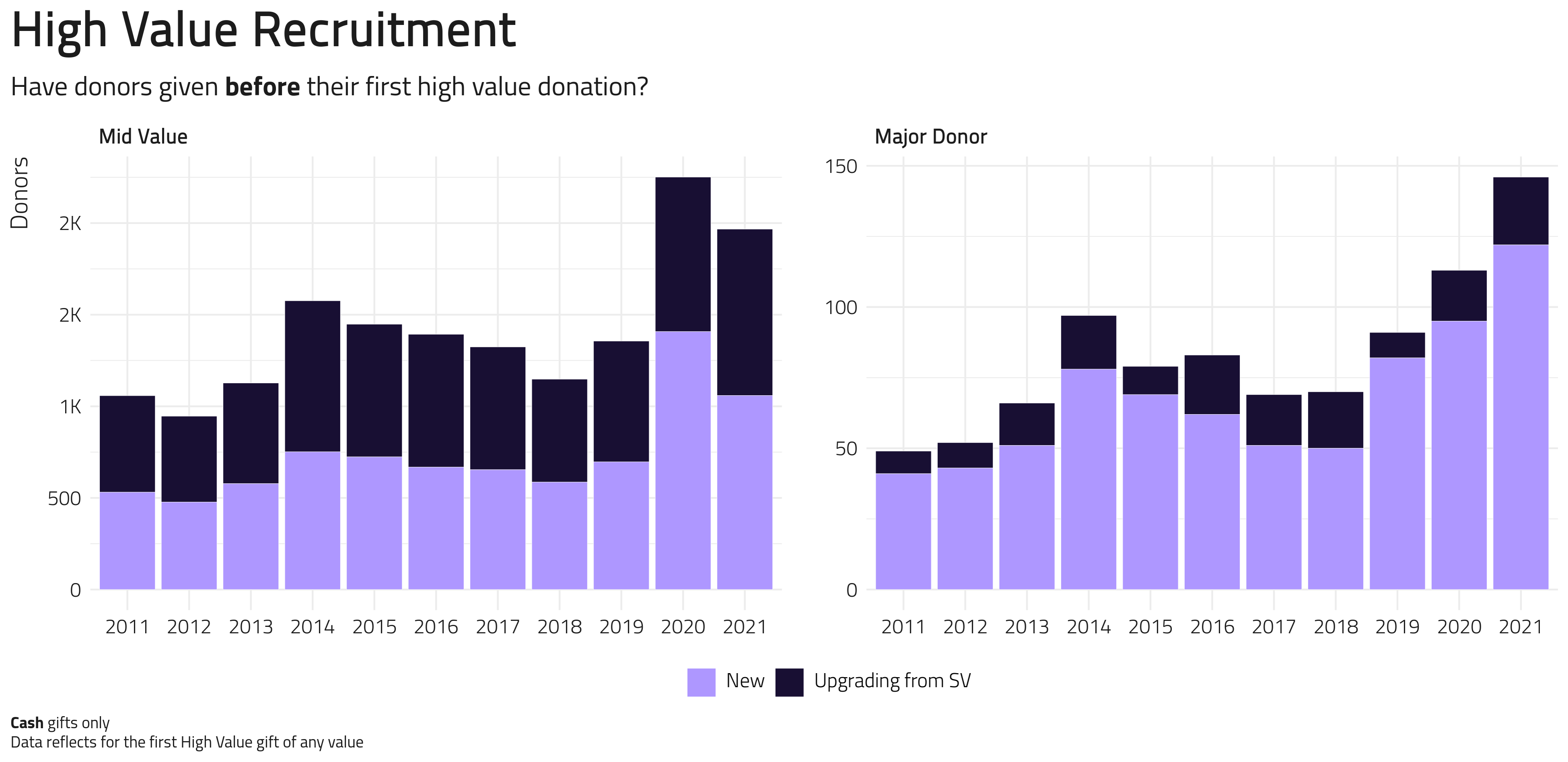

High-Value recruitment trend (member charities)

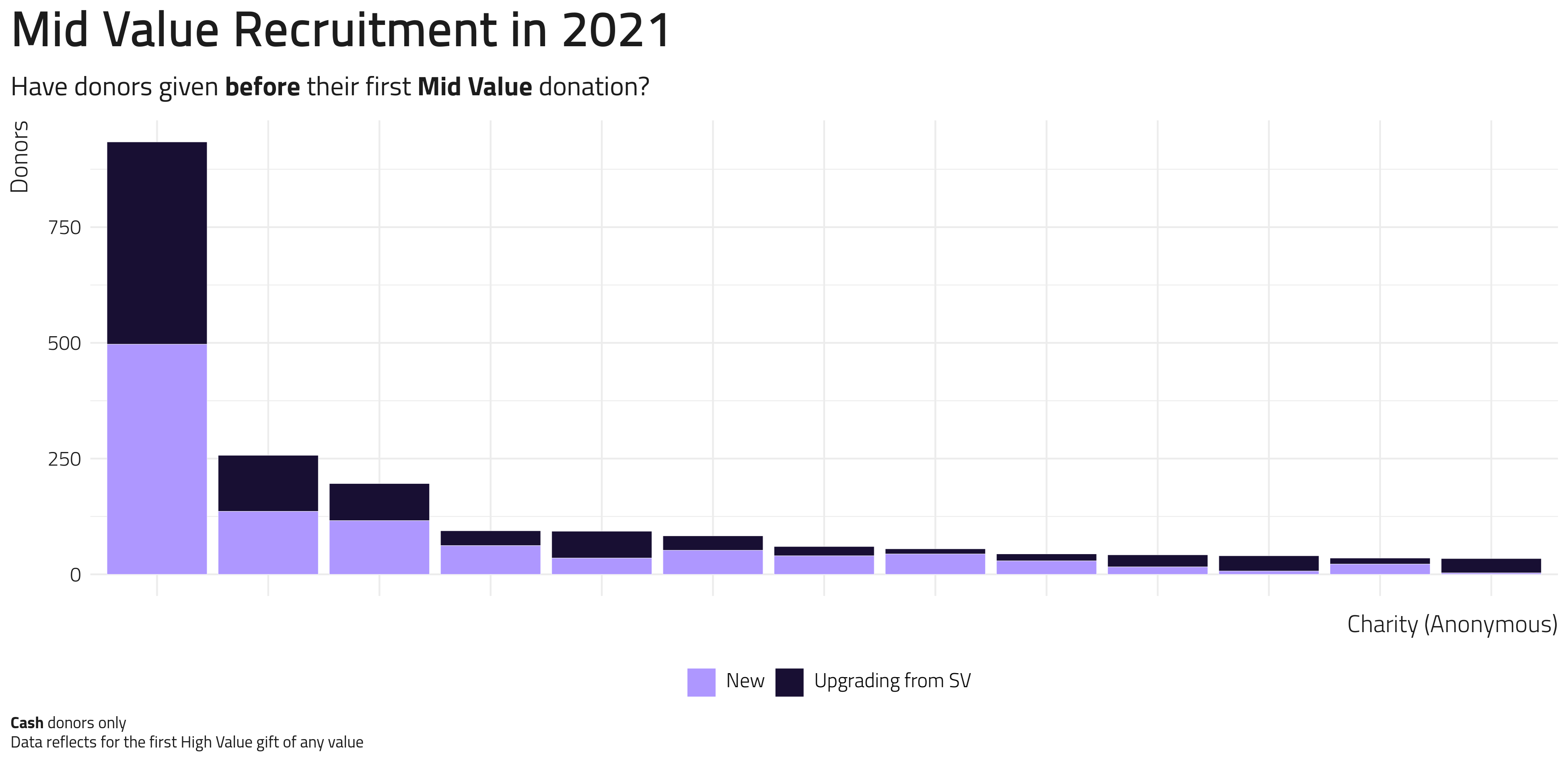

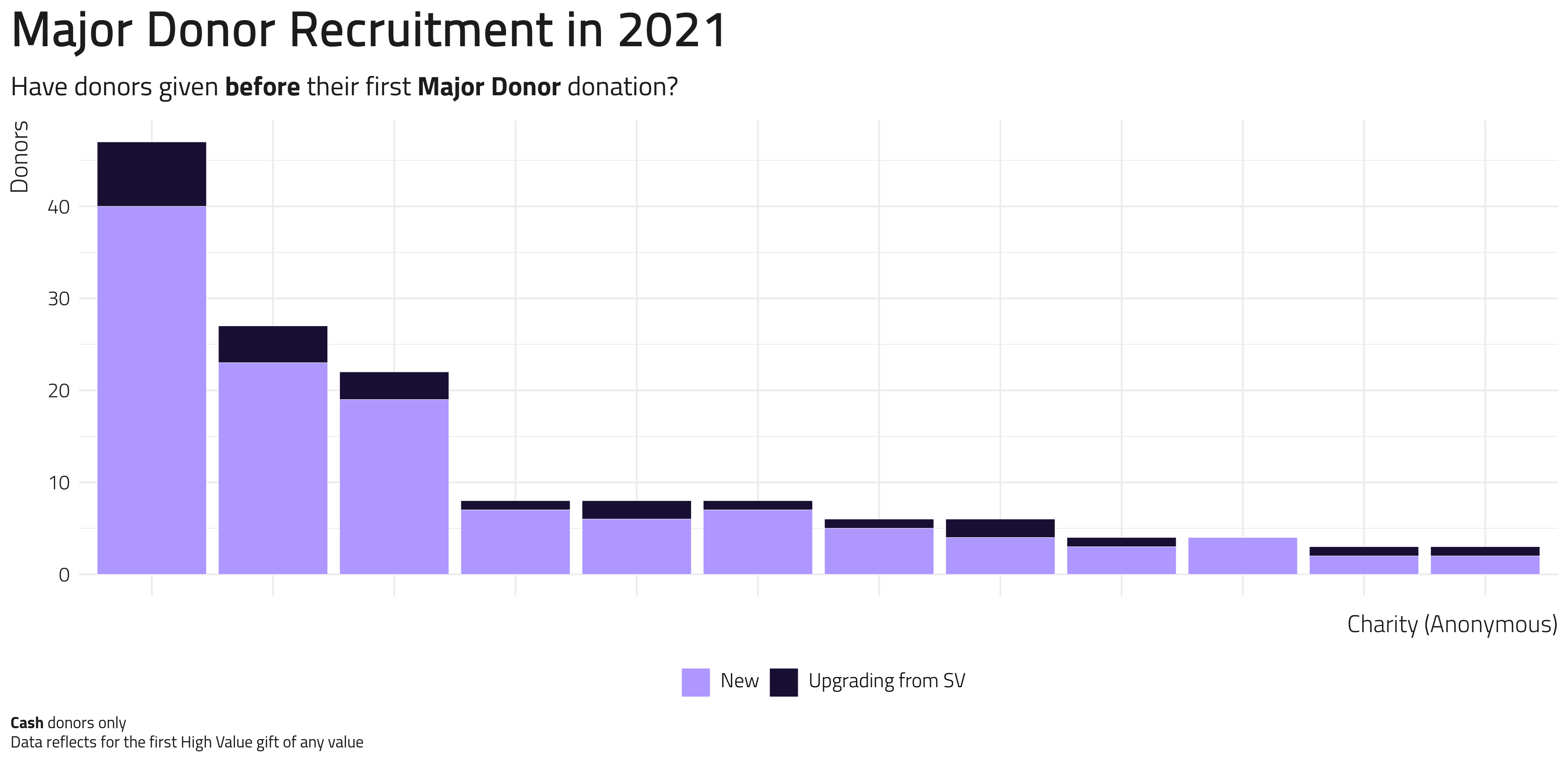

When we look at the mix of participating charities, we can see that it isn’t limited to just a few charities.

Mid Value recruitment in 2021 (member charities)

Major Donor recruitment in 2021 (member charities)

Further investigation suggests that while many of these donors are classified as ‘cash donors’ at recruitment, they aren’t typically recruited by our acquisition activity. Often these donors are classified as ‘cash donors’ after the fact.

So what should we do with this information? Well, it suggests we should ask for evidence of these statements where we can and see if they can be validated or verified by other experts in the sector.

It does, however, raise questions that we’d like to explore further in our FY23 Fundraising Insights program. We’ll investigate further into high-value recruitment; where do high-value donors come from? What proportion of our ‘actively recruited’ donors go on to make high-value gifts, and how much does this help to improve our acquisition? What proportion of donors are recruited from our acquisition programs at a high-value level?

If you’re interested in getting a better understanding of your high-value donors, register today for Fundraising Insights. Our next report is planned for October 2022.